Don’t leave your finances to the last minute!

Some people work better under pressure. Douglas Adams, author of The Hitchhikers’ Guide to the Galaxy famously said “I love deadlines. I love the whooshing noise they make as they go by.”

But if there’s one thing you can’t afford to put off till later, it’s anything to do with your finances.

We’ve come across a couple of examples of this recently, where clients have come to us asking for pension planning in their 60s or 70s. A couple of these had policies where the deadline for converting them into cash was just a few weeks away.

What they hadn’t realised was how much needed to be done before that deadline – so if you get a letter, please don’t just ignore it!

For example, we have to be granted permission from the pension provider to act on your behalf – but it can often take a minimum of 10 working days to simply get an initial response from some!

Then there’s the time it can take to track down certain pensions – some policies will have been bought and sold by various companies since they were first taken out. Once, a client produced a policy document from a 1990s Filofax! We tracked the company down eventually, but it changed its name several times since the initial purchase was made.

This explains why much of Sam’s time is spent on the phone, taking to providers, or simply being on hold to them – in fact some of her favourite songs have been ruined by listening to endless repeats of the ‘hold music’ version (she can never listen to Stevie Wonder’s For Once in My Life again!).

Think ahead

Leaving something as important as planning your pension until too late can also run the risk of not having enough to live on in retirement.

As we’ve explored in a previous post, many people believe that releasing money from their property by downsizing, will be enough to see them through retirement. This plan can often disappoint, as hidden costs and the potential for fluctuating house prices mean there might not be as much value there as hoped.

Money makes money

Of course, when it comes to your finances, one of the most important reasons not to leave things too late, is ‘compound interest’.

In simple terms, ‘compounding’ means you earn interest not just on the principal investment (your initial deposit) but on the reinvested interest as well. So the earlier you save, the more of this there will be.

But put that another way, the later you start, the more you could be missing out on.

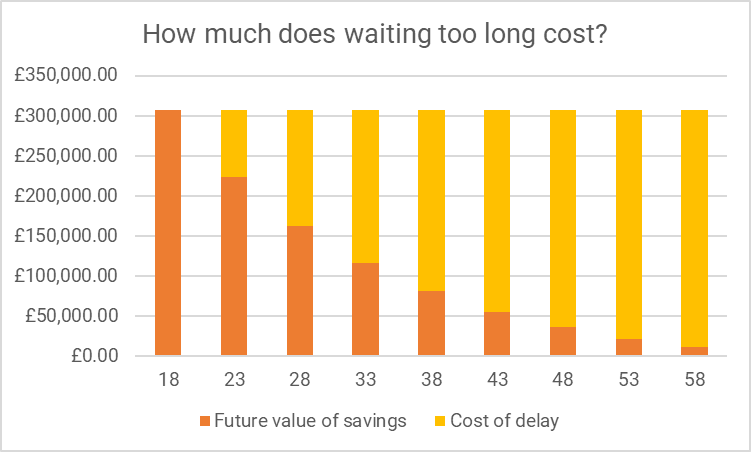

To give you an example an 18-year-old saving £100 a month (assuming an interest rate of 7%) would be looking at a pension pot of more than £300,000 by the time they reach 65. As we can see from the chart below, delaying this start date by just 10 years means that value goes down by half.

To get to the same final pension pot, the 28-year-old would need to roughly double their monthly contributions.

Source: unbiased.co.uk Cost of Delay tool. Based on an annual investment of £1,200, and a stakeholder pension with yearly growth of 7% and fund charges of 1% a year. Assumes contributions are level and don’t increase in line with inflation over the time you save. Past performance is not a gurantee of future returns.

Hindsight is a wonderful thing

There’s no need to give up hope if you didn’t start early. Compounding still has benefits for those investors who start later.

One of the most vital lessons from the history of financial markets is the importance of staying invested. During the big market crashes, such as the global financial crisis, or the coronavirus pandemic, it was those investors who didn’t panic and try to take their money out of the market entirely that were most successful in weathering the storms.

Thanks again to compound interest, when markets started to rise again, an investor who stayed in the market was more likely to see greater returns, than one who had tried to time the market and pull out when share prices dropped.

Planning prevents panic

The final benefit of speaking to an adviser and drawing up a proper plan is that it gives you the time and space to get what you need.

You have time to think about what kind of lifestyle you want in retirement and breathing room to put everything in place. We can also help you get the basics sorted – setting up an emergency fund, making sure credit card debt and mortgages are all taken care of.

And speaking to an adviser at every stage – not just at retirement – also helps ensure your finances stay on track. For example with the current cost-of-living crisis, we’re all looking for ways to cut back. But don’t cut back on the wrong things! We can help you to make adjustments that won’t affect your retirement plan and financial future.

With an adviser, you can be more assured that things are in place so you can actually enjoy your retirement. Much better than panicking with a last-minute deadline we think!