3 reasons not to move your stocks to cash

It’s not often that the average person gets excited about numbers and percentages (apart from us of course!). However at the moment, there’s a lot of attention on the recent interest rate rise – especially from those with money invested.

After years in the doldrums savings accounts are looking attractive once again, tempting many to think about moving their money into cash.

However, while it may seem like a good option, it’s not always the best move. Let’s take a look at why.

But first, a recap

In June, the Bank of England put interest rates up to 5%. It’s the highest level for the cost of borrowing in nearly 15 years – and a far cry from the rock-bottom levels seen over the last decade.

The rise is very bad news for mortgages - the average rate for a two-year fixed mortgage has now risen to more than 6%, meaning those who are due to renew this year face a potential increase of nearly £3,000 a year.

However, it’s a boost for those with cash savings. Current deals on offer are up to 4.15% for easy access or 5.7% for fixed rates.[1] As a result some clients have come to us tempted by the short-term potential of moving their money into cash. What makes cash seem even more attractive is that it’s seen as a ‘safe haven’ compared to the stock market.

However, unfortunately it’s not that simple. Here are three reasons why it’s not a good idea to move all your stocks into cash.

1. Unpredictability

UK interest rates are at their highest since 2008. And the Bank of England has said it’s prepared to go higher still to keep inflation in check.

But look back over the last decade and interest rates were much, much lower. The chart below shows the relative performance of cash vs inflation since 1987. You can see that the real interest rate was highest during the 80s when inflation was high but declined gradually, turning negative from 2008 and largely remaining that way, apart from a short period in 2015-16.

The bottom line here is that you might find an attractive interest rate for cash for a short period, but it will only be a temporary fix.

Of course you might think that you could move your money back from cash to stocks when interest rates (inevitably) fall again. However it’s not as easy as it sounds.

Timing the market requires accurately predicting interest rate movements and the overall performance of different asset classes. Numerous studies have shown that this is almost impossible to achieve – even by the most ‘talented’ wealth managers! Instead it’s much more effective to maintain a disciplined approach than to make impulsive decisions based on short-term market movements.

2. Opportunity cost

Following on from this, we can see the impact of how taking a short-term view could have a big impact on your long-term finances.

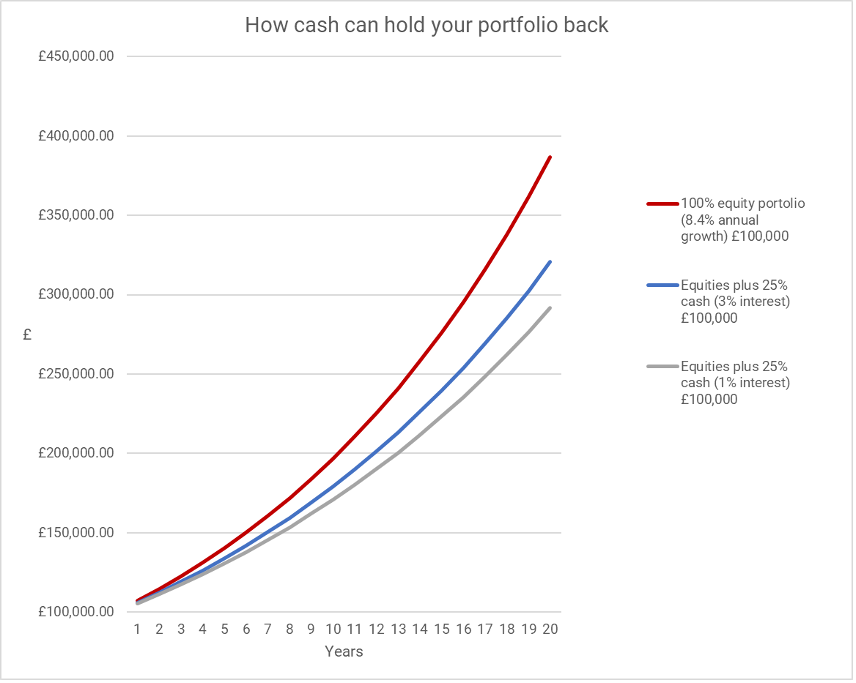

The chart below shows just how much taking capital out of the market can cost you.

We’ve taken a hypothetical equity portfolio with an annual return of 7%. Then we’ve compared it with that a portfolio where three quarters are invested in shares and the rest in cash, earning either 1% or 3% interest.

Over 20 years, there’s a tangible difference in outcome. The 100% equities portfolio is worth around £390,000. The investor who split their equity between equities and cash is left worse off by between £66,000 and £95,000.

For illustrative purposes only. Assumes a hypothetical 7% return for shares after costs. Based on this research from Vanguard.

3. Inflation

Finally, there’s inflation, which over the long-term will eat into the value of your savings and leave you with far less purchasing power than you imagine.

Goods worth £10,000 in 2013 would cost us £14,040 today, considering the rate of inflation over the last 10 years. Meanwhile, had you placed £10,000 in the average building society a decade ago, you’d be rewarded with just £470 in interest today.

By keeping your money invested, you have a better chance of outpacing inflation and preserving your purchasing power. You also have the potential to benefit from compounding growth.

The answer to being a successful investor is in fact very boring: stay the course, be patient and ride out the storm. Asset allocation based on your risk tolerance, investment objectives, and time horizon is a more prudent approach to maximising long-term returns.

In conclusion then, while high interest rates may make cash seem appealing, moving money out of investments and into cash should be a carefully considered decision.

Please get in touch if you’d like to find out more.

[1] Money Saving Expert as of 22 June 2023